Purchase test

Please ensure that you enter the correct email address for the candidate!

Test in Swedish on Swedish GAAP. Suitable for all seniority levels. Covers four areas with 24 multiple-choice questions at easy, intermediate, and difficult levels. Questions and answer order are randomly generated, ensuring unique yet comparable tests.

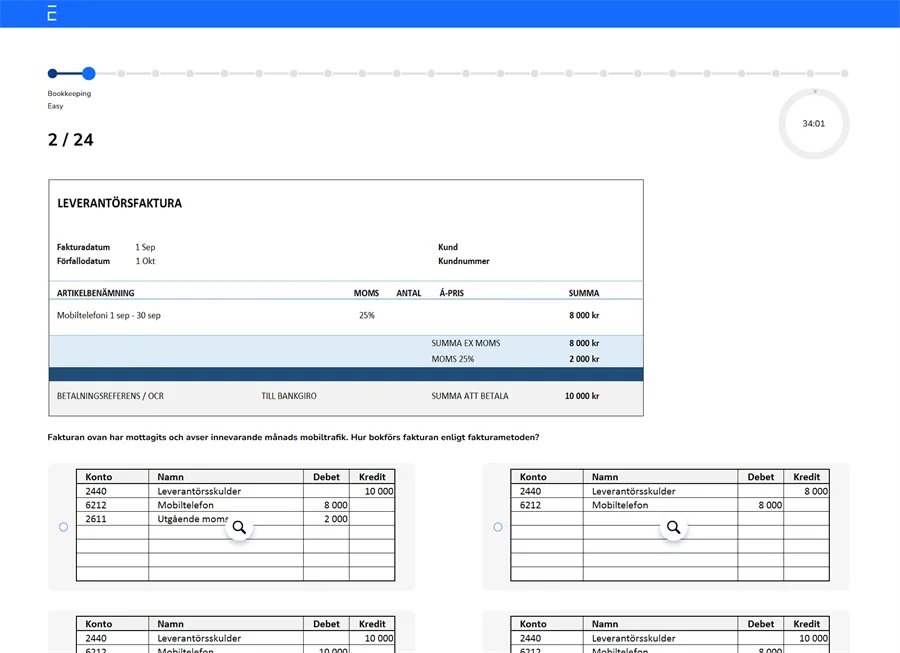

Bookkeeping

- Testing of basic bookkeeping

- Common customer and supplier invoices

- Representation and receipts

- Correction of a recorded transaction

- Credit invoices, etc.

- More advanced accounting

- Salaries

- Accrued vacation pay

- Invoices in foreign currency

- Tax revenues, etc.

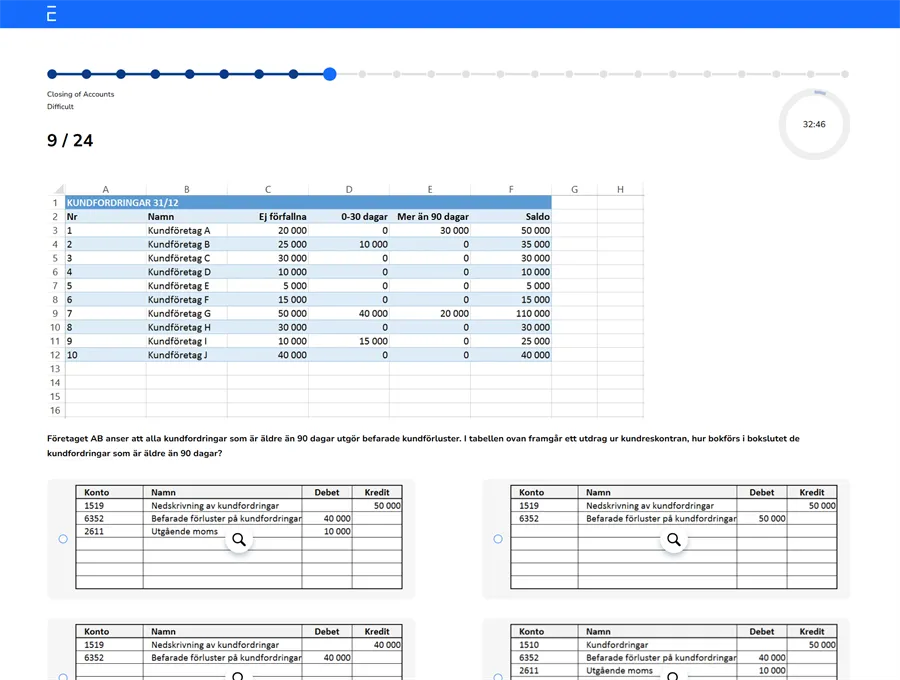

Closing of Accounts

- Account reconciliations

- Accruals

- Various interim accounts

- Closing VAT accounts

- Accrual of invoices

- Recording of taxes and inventory

- Computation of taxable income

- Accounting for anticipated and recognised customer losses, etc.

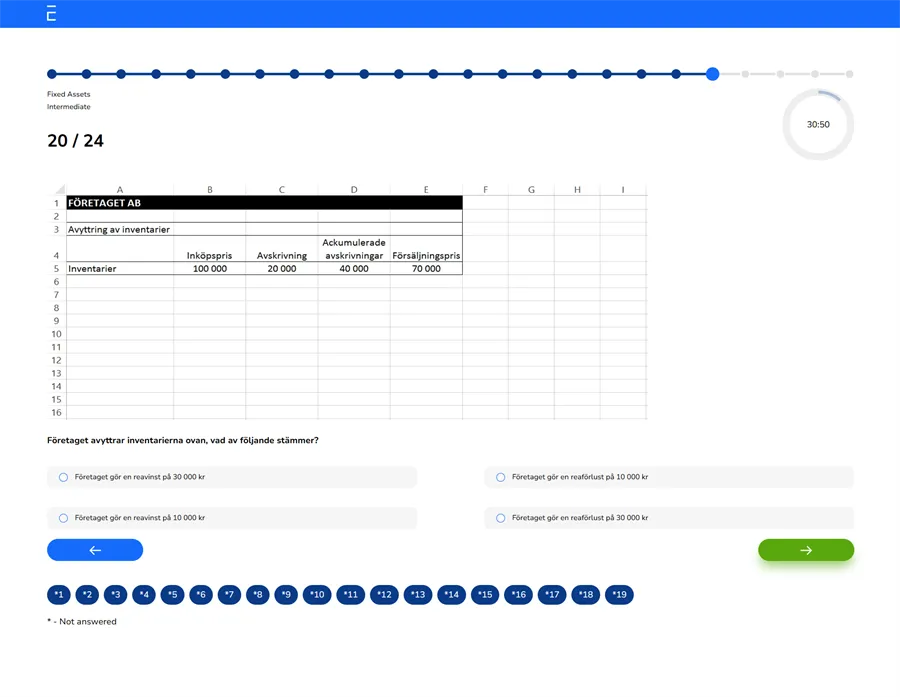

Fixed Assets

- Various types of fixed assets

- Fixed asset registers

- Depreciation and write-downs

- Tax depreciation (SV: Huvud- och Kompletteringsregeln)

- Consumable inventories

- Goodwill

- Impairment testing under IFRS

- Calculation of capital gains, etc.

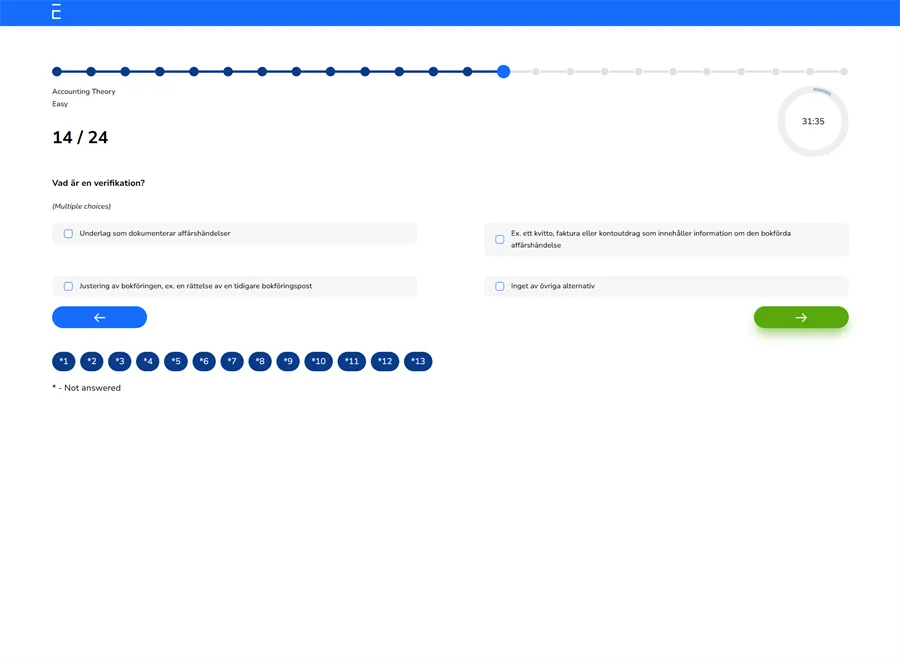

Accounting Theory

- Understanding the meaning and purpose of verifications

- Monthly reconciliations

- Accruals, accrued and prepaid items

- Definitions of revenue and expenses

- Consolidated financial statements

- Elimination of internal transactions

- Percentage of completion

- Significance of various accounting principles

- Indirect method regarding cash flow

- IFRS vs. K3 regarding financial instruments

- Useful life for intangible assets, etc.