Purchase test

Please ensure that you enter the correct email address for the candidate!

Test in Swedish on Swedish GAAP. Suitable for all seniority levels. Covers four areas with 24 multiple-choice questions at easy, intermediate, and difficult levels. Questions and answer order are randomly generated, ensuring unique yet comparable tests.

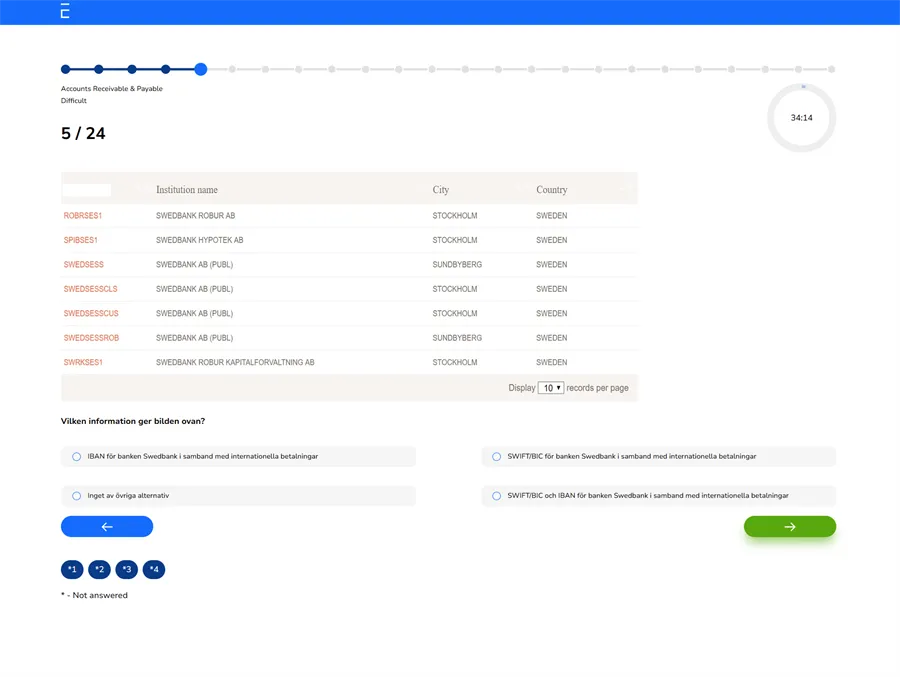

Accounts Receivable & Payable

- Ledgers

- Invoices

- Input and output VAT

- Accounts

- Manual reconciliation

- Payments

- Bank transfers

- Accounting dates

- Discrepancies

- Credit invoices

- Accrual of customer and supplier invoices

- Incorrect invoices

- International payments, etc.

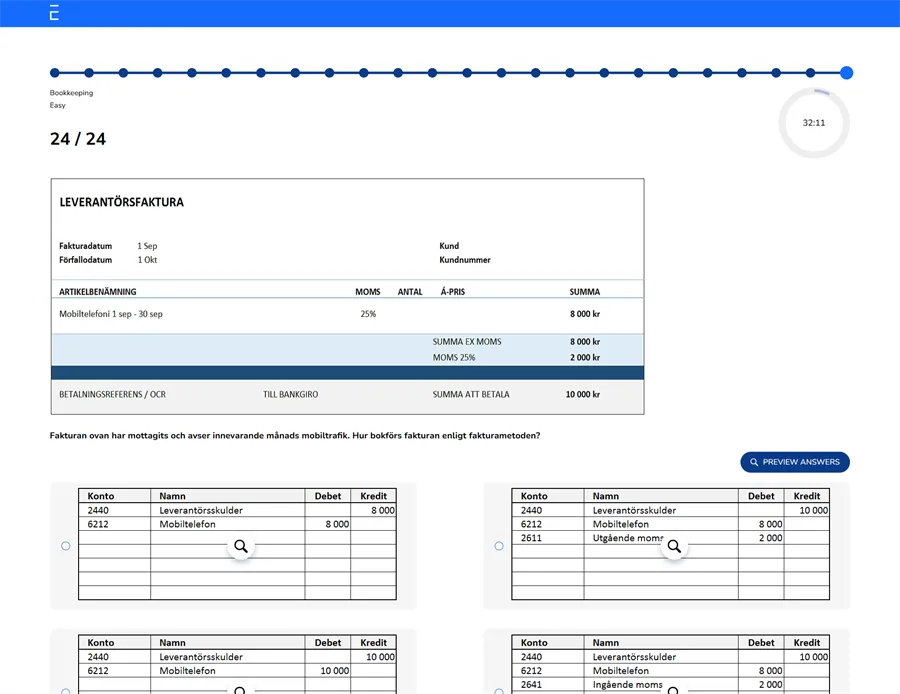

Bookkeeping

- Testing of basic bookkeeping

- Common customer and supplier invoices

- Representation and receipts

- Correction of a recorded transaction

- Credit invoices, etc.

- More advanced accounting

- Salaries

- Accrued vacation pay

- Invoices in foreign currency

- Tax revenues, etc.

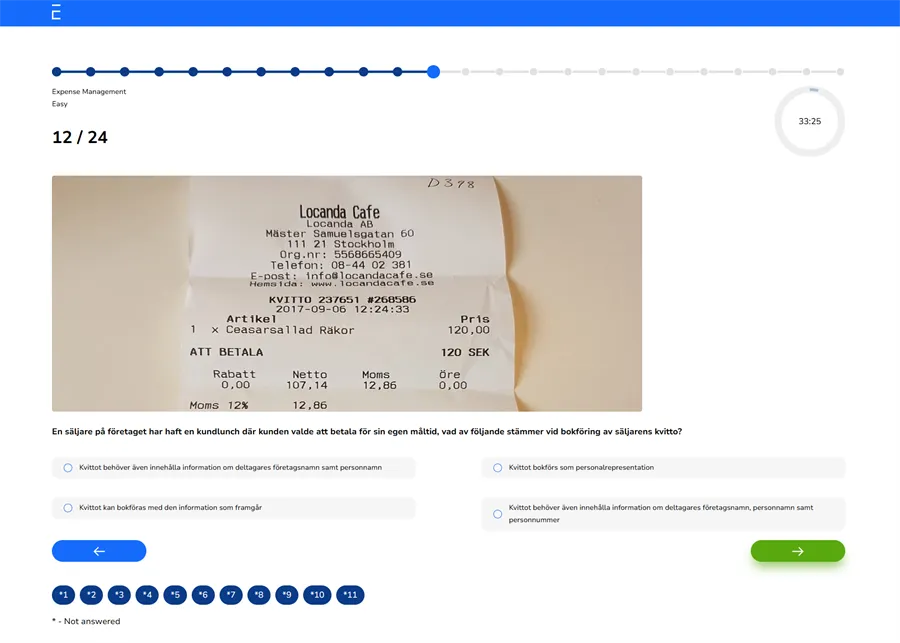

Expense Management

- Receipt management

- Representation

- Archiving rules

- Various VAT rates

- Meals and alcoholic beverages

- Travel expenses

- Tax-free per diems

- Foreign invoices

- Reverse charge, etc.

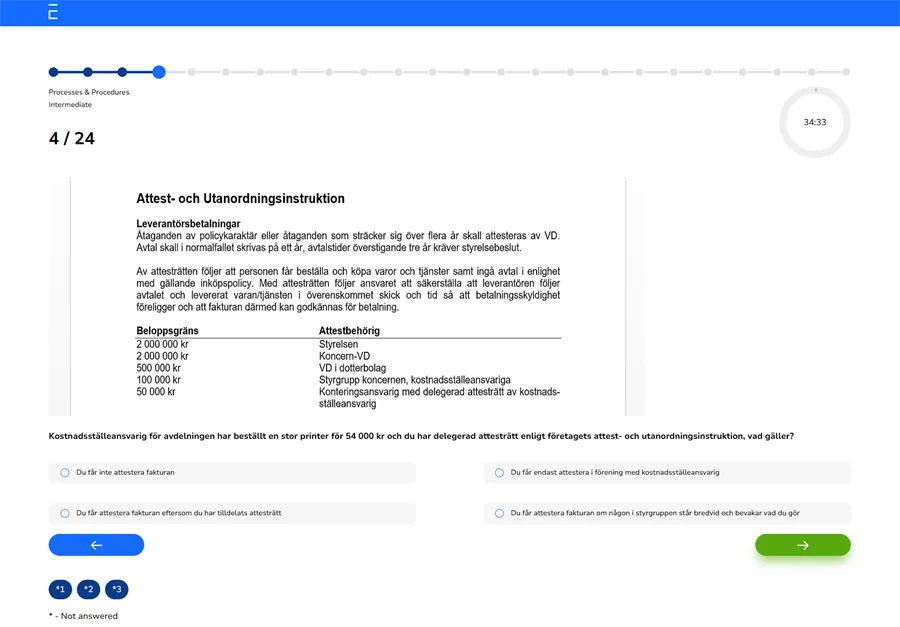

Processes & Procedures

- Meaning and purpose of authorisation

- The process for the arrival registration of invoices

- Necessary information in accounting records

- Rules on authorisation and invoice registration

- The double-entry principle

- Identification and handling of fraudulent invoices

- Delegated authorisation authority and immediate superior

- Rules for approving payments, etc.