Excel 1 - SV - SV settings

The Everyday Excel UserTest in Swedish with Excel in Swedish settings. Ideal for candidates with limited data-intensive tasks or complex models. Assesses general proficiency in everyday use.

Date

21 Aug 2025

| Candidate: |

Henrik Dennerheim |

| Competence: |

Competent - level: 3 of 4 |

| Time spent: |

17:09 of 45:00 |

| Issuer: |

Demo Kunskapstest, EPROVED |

| Test | Competence | Points | Answered | Status | Date |

|---|---|---|---|---|---|

|

Accounting Firm Edition - SV - Senior |

3/4 |

70% |

27/30 |

Complete |

2025-08-21 14:40:01 |

|

Kvalificerad redovisning |

1/4 |

16% |

6/24 |

Complete |

2024-10-01 10:40:55 |

|

Kvalificerad redovisning |

2/4 |

25% |

10/24 |

Complete |

2024-03-07 11:39:12 |

|

Kvalificerad redovisning |

1/4 |

6% |

4/24 |

Complete |

2024-02-07 13:52:25 |

|

Kvalificerad redovisning |

1/4 |

9% |

5/24 |

Complete |

2024-01-10 14:25:37 |

|

Kvalificerad redovisning |

1/4 |

21% |

8/24 |

Complete |

2023-11-22 09:34:29 |

|

Kvalificerad redovisning |

1/4 |

16% |

7/24 |

Complete |

2023-11-08 13:41:17 |

|

Kvalificerad redovisning |

1/4 |

15% |

5/24 |

Complete |

2023-10-13 10:42:48 |

|

Kvalificerad redovisning |

2/4 |

27% |

11/24 |

Complete |

2023-10-06 11:39:25 |

|

Kvalificerad redovisning |

1/4 |

17% |

8/24 |

Complete |

2023-10-06 10:16:35 |

The candidate exhibits strong expertise in accounting and is proficient in bookkeeping, closing accounts, fixed assets, and accounting theory, among other areas. They also demonstrate practical competence in client-related scenarios typically encountered in an accounting firm environment.

Beginner

0% - 24%

Basic Proficiency

25% - 49%

Competent

50% - 76%

Skilled

77% - 100%

The candidate demonstrates strong proficiency in accounting, including posting customer and supplier invoices, handling representation, receipts, expenses, accounting corrections, payroll, accrued vacation pay, and more.

The candidate has basic knowledge of closing accounts and can, for example, handle reconciliations, accruals at a basic level, and, to some extent, taxes and VAT.

The candidate demonstrates advanced knowledge of fixed assets, including asset classification, depreciation, write-downs, and the distinction between economic and physical life. They also show strong theoretical understanding of prepaid income, accrued expenses, the matching principle, and cash flow interpretation using the indirect method.

The candidate demonstrates solid understanding of financial statements, including equity, short-term liabilities, and appropriations. They are able to apply key concepts in financial analysis, such as calculating solvency and debt ratios, return on equity adjusted for untaxed reserves, and deriving inventory purchases through reconciliation of financial statements.

The candidate demonstrates sound judgement in typical accounting firm assignments, including dividend planning in owner-managed companies, handling deadlines, interpreting engagement documents, and evaluating capital adequacy and other regulatory aspects in client discussions.

Points

Time

Points

Time

Henrik Dennerheim's score was 40% above the average of all other test-takers.

Henrik Dennerheim's score was 37% above the average for the benchmark group (Qualified Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 40% above the average of all other test-takers.

Henrik Dennerheim's score was 37% above the average for the benchmark group (Qualified Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 40% above the average of all other test-takers.

Henrik Dennerheim's score was 37% above the average for the benchmark group (Qualified Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 4% above the average for the benchmark group (Qualified Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 48% below the average for the benchmark group (Qualified Accounting - Specialist, 4-6 yrs).

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

| Question | Question area | Question type | Time | Status | Level |

|---|---|---|---|---|---|

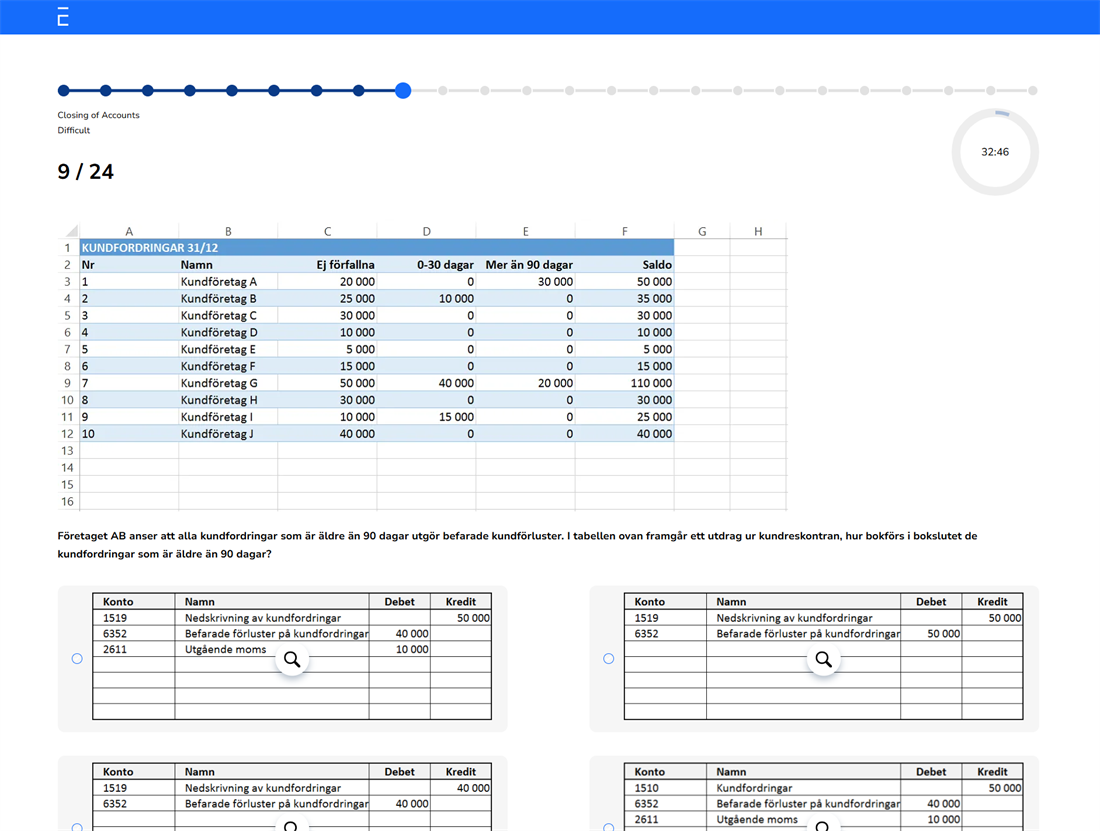

| 7 | Closing of Accounts |

Record recognised customer losses

0 of 1 correct answers and 1 wrong and got 0 out of 3 points |

00:31 | Difficult | |

| 9 | Accounting Practice in Client-Facing Roles |

Calculate current year’s tax expense – taking into account capitalised tax loss carry-forwards and non-deductible expenses

1 of 2 correct answers and 0 wrong and got 1,5 out of 3 points |

00:49 | Difficult | |

| 10 | Financial Statements & Analysis |

Capitalised Tax Loss Carryforwards

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:41 | Difficult | |

| 12 | Financial Statements & Analysis |

Calculate Return on Equity, Adjust for Tax-Free Reserves

0 of 1 correct answers and 1 wrong and got 0 out of 3 points |

00:52 | Difficult | |

| 13 | Accounting Practice in Client-Facing Roles |

Owner-managed companies – key points in dividend advice

2 of 2 correct answers and 0 wrong and got 3 out of 3 points |

00:25 | Difficult | |

| 14 | Bookkeeping |

Record supplier invoice, foreign currency & reverse charge mechanism (posting)

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:10 | Difficult | |

| 17 | Fixed Assets & Accounting Theory |

Matching principle, definition and meaning in accounting

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:13 | Difficult | |

| 22 | Bookkeeping |

Correct an incorrectly recorded transaction, statements regarding reverse debit and credit

0 of 2 correct answers and 0 wrong and got 0 out of 3 points |

00:04 | Difficult | |

| 24 | Closing of Accounts |

Record anticipated customer losses

0 of 1 correct answers and 1 wrong and got 0 out of 3 points |

00:40 | Difficult | |

| 26 | Fixed Assets & Accounting Theory |

Meaning of cash flow analysis, indirect method (cash flow related to operations, investments, financial capital)

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:15 | Difficult | |

| 1 | Accounting Practice in Client-Facing Roles |

Who must sign the annual accounts

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:15 | Easy | |

| 2 | Accounting Practice in Client-Facing Roles |

Meaning of statement of engagements (SV: ’Engagemangsbesked’)

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:16 | Easy | |

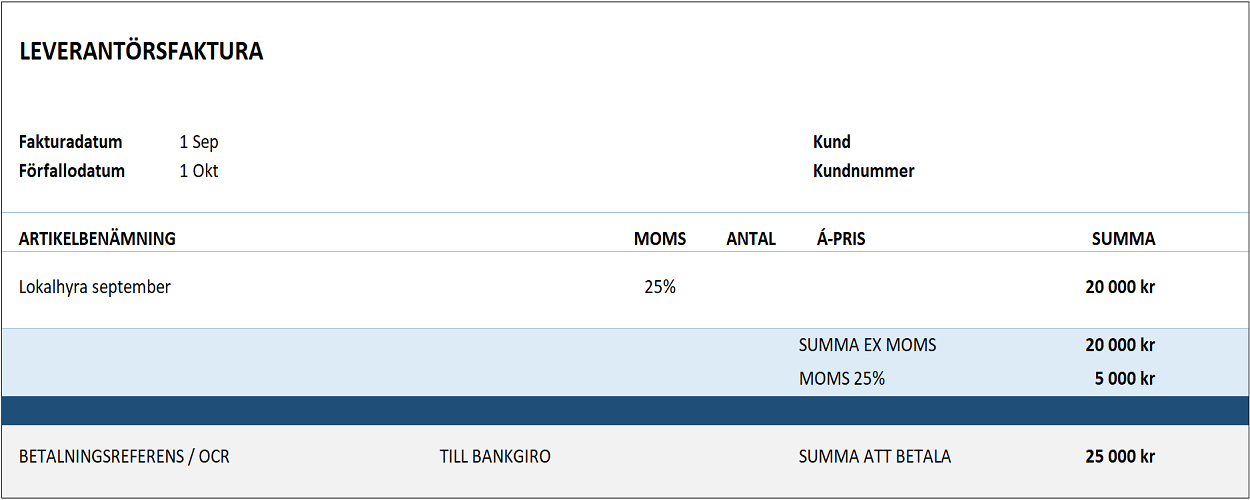

| 6 | Bookkeeping |

Record supplier invoice, invoice method for VAT taxable sales (posting) *

3 of 3 correct answers and 0 wrong and got 1 out of 1 points |

01:56 | Easy | |

| 8 | Bookkeeping |

Record representation expenses and necessary information on the receipt

2 of 2 correct answers and 0 wrong and got 1 out of 1 points |

00:28 | Easy | |

| 11 | Fixed Assets & Accounting Theory |

Depreciation of tangible fixed assets, economic useful life vs. physical useful life

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:16 | Easy | |

| 15 | Financial Statements & Analysis |

Year-End Adjustments, Accelerated Depreciation

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:14 | Easy | |

| 19 | Financial Statements & Analysis |

Short-Term Liabilities

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:17 | Easy | |

| 25 | Closing of Accounts |

Accrual of supplier invoices at year-end, interim receivable vs. interim liability

1 of 2 correct answers and 0 wrong and got 0,5 out of 1 points |

00:30 | Easy | |

| 27 | Fixed Assets & Accounting Theory |

Impairment of fixed assets, tangible vs. intangible & depreciation vs. impairment

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:16 | Easy | |

| 29 | Closing of Accounts |

Accrual of a supplier invoice at year-end, statements of correct handling

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

01:25 | Easy | |

| 3 | Closing of Accounts |

At year-end, valuation of inventory, interpret a calculation, and record an increase (posting)

0 of 1 correct answers and 0 wrong and got 0 out of 2 points |

00:34 | Intermediate | |

| 4 | Accounting Practice in Client-Facing Roles |

Late filing – rules and consequences for annual accounts

2 of 2 correct answers and 0 wrong and got 2 out of 2 points |

00:19 | Intermediate | |

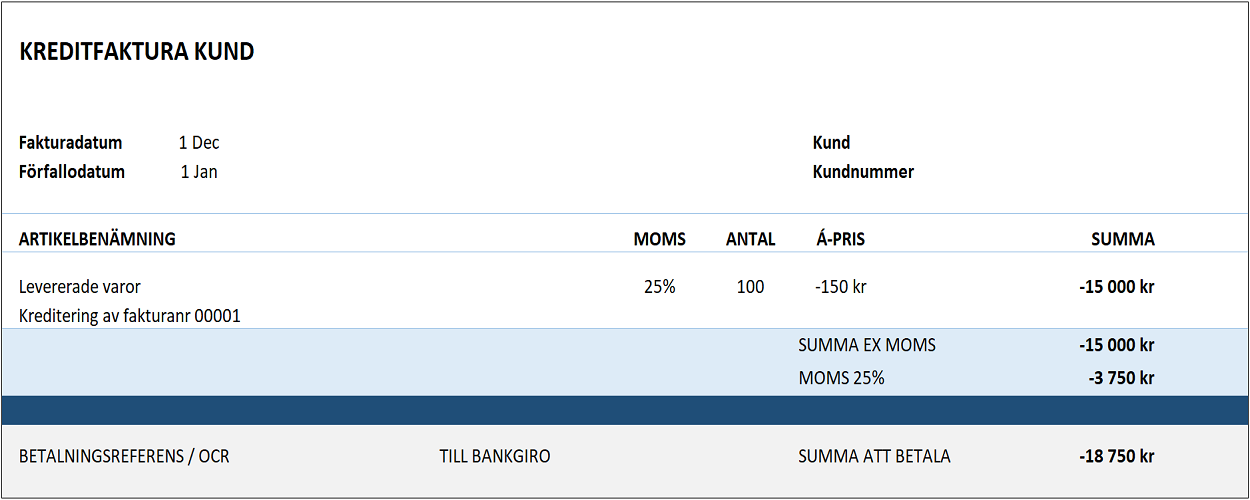

| 5 | Bookkeeping |

Record customer invoice, credit invoice under the invoice method, and VAT taxable sales (posting) *

3 of 3 correct answers and 0 wrong and got 2 out of 2 points |

01:05 | Intermediate | |

| 16 | Fixed Assets & Accounting Theory |

Accrued expense, definition and meaning in accounting

2 of 2 correct answers and 0 wrong and got 2 out of 2 points |

00:20 | Intermediate | |

| 18 | Accounting Practice in Client-Facing Roles |

Equity – when a balance sheet for liquidation purposes must be prepared

0 of 1 correct answers and 0 wrong and got 0 out of 2 points |

00:12 | Intermediate | |

| 20 | Closing of Accounts |

Accrual of a received supplier invoice, relevant accounts for prepaid expenses

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:18 | Intermediate | |

| 21 | Fixed Assets & Accounting Theory |

Prepaid revenue, definition and meaning in accounting

2 of 2 correct answers and 0 wrong and got 2 out of 2 points |

00:18 | Intermediate | |

| 23 | Bookkeeping |

Record representation expenses, alcoholic beverages (posting)

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:44 | Intermediate | |

| 28 | Financial Statements & Analysis |

Derive Purchases through the Income Statement and Balance Sheet

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

02:02 | Intermediate | |

| 30 | Financial Statements & Analysis |

Equity, Fund and New Issuances

2 of 2 correct answers and 0 wrong and got 2 out of 2 points |

00:24 | Intermediate |

* - Questions with this symbol are account distribution questions.

Correct answer

Weighted point, partly right on the question

Wrong answer

Either skipped or out of time

Företaget har skickat kreditfakturan ovan, hur bokförs kundfakturan om företaget bedriver momspliktig försäljning och tillämpar fakturametoden?

| Account | Account name | Debet | Credit |

|---|---|---|---|

Leverantörsfakturan ovan har mottagits, hur bokförs den om företaget bedriver momspliktig försäljning och tillämpar fakturametoden?

| Account | Account name | Debet | Credit |

|---|---|---|---|

TEST AREAS

"ACCOUNTING FROM A TO Z"

Test in Swedish on Swedish GAAP. Designed to distinguish senior accountants and client-facing specialists in accounting firms with broader reporting and advisory responsibilities.

Bookkeeping

Covers recording of supplier and customer invoices, including credit and debit notes, representation expenses with correct documentation, payroll transactions including tax and social charges, accrued vacation pay, foreign currency transactions with reverse charge VAT, and correcting incorrectly posted entries including reversed debits and credits.

Closing of Accounts

Covers the closing process for VAT and tax accounts, accruals and deferrals of supplier and customer invoices, use of interim accounts, inventory valuation, computation of taxable income versus accounting result, and accounting for both anticipated and confirmed customer losses.

Fixed Assets & Accounting Theory

Covers concepts such as depreciation and impairment of tangible and intangible assets, economic vs. physical useful life, and when low-value assets may be expensed. Also includes core theoretical principles like accrued and prepaid items, the matching principle, and the structure and interpretation of cash flow statements using the indirect method.

Financial Statements & Analysis

Covers core components of the income statement and balance sheet, including equity, short-term liabilities, appropriations and deferred taxes, as well as analytical skills such as calculating solvency and debt ratios, return on equity (adjusted for untaxed reserves), and deriving inventory purchases through statement reconciliation.

Accounting Practice in Client-Facing Roles

Covers practical aspects of working as an accounting consultant, including understanding filing deadlines, handling dividend advice in owner-managed companies, interpreting engagement letters and balance sheet equity, assessing compliance risks, and responding to client questions about leasing, capital adequacy or regulatory obligations. Emphasis is placed on judgement, communication, and regulatory awareness in assignments for small and medium-sized enterprises (SMEs).

TEST QUESTIONS

Multiple Choice and Manual Entry Questions

Our tests are mainly based on multiple-choice questions where the number of correct answer options varies. Each question has four answer options. Some questions require manual recording of a business transaction, and the candidate is provided with a chart of accounts for assistance.

Questions by Area and Difficulty

The tests are divided into four question areas and questions are categorised into three difficulty levels: easy, intermediate and difficult.

Randomised Test Generation

Questions within each area and difficulty level are randomly selected from a question bank, ensuring that each test receives a unique set of questions. Additionally, the order of answer options is randomised so that the correct answer for each question never appears in the same position.

30 Questions and Multimedia Options

A total of 30 questions are generated and must be answered within 45 minutes. During the test, candidates can skip questions and come back to them later. They also have access to a timer and a progress indicator. The test will automatically close when the maximum time limit is reached.

Test questions and answer options can consist of text, images, or a combination of text and images.

Example Question