Excel 1 - SV - SV settings

The Everyday Excel UserTest in Swedish with Excel in Swedish settings. Ideal for candidates with limited data-intensive tasks or complex models. Assesses general proficiency in everyday use.

Date

08 May 2025

| Candidate: |

Henrik Dennerheim |

| Competence: |

Competent - level: 3 of 4 |

| Time spent: |

07:00 of 30:00 |

| Issuer: |

Demo Kunskapstest, EPROVED |

| Test | Competence | Points | Answered | Status | Date |

|---|---|---|---|---|---|

|

Financial Controller - SV |

3/4 |

56% |

19/24 |

Complete |

2025-05-08 13:28:12 |

|

Financial Control |

1/4 |

0% |

0/24 |

Complete |

2022-10-11 13:35:54 |

|

Financial Control |

1/4 |

12% |

3/24 |

Complete |

2021-11-10 10:39:55 |

The candidate demonstrates strong skills in financial control, particularly in accounting and financial analysis.

Beginner

0% - 24%

Basic Proficiency

25% - 49%

Competent

50% - 76%

Skilled

77% - 100%

The candidate demonstrates basic knowledge of an income statement and a balance sheet, including their meaning, format, and the ability to distinguish between key items.

The candidate demonstrates extensive and in-depth knowledge in financial analysis and, in addition to key ratios, profitability, financial position, and capital binding, also masters the underlying relationships between the income statement and balance sheet from an analytical perspective.

The candidate has basic knowledge of closing accounts and can, for example, handle reconciliations, accruals at a basic level, and, to some extent, taxes and VAT.

The candidate demonstrates strong theoretical knowledge in accounting and, in addition to basic bookkeeping, is able to understand definitions, accruals, interim accounts with conceptual pairs, accounting principles, methods for cash flow analysis, and more.

Points

Time

Points

Time

Henrik Dennerheim's score was 37% above the average of all other test-takers.

Henrik Dennerheim's score was 27% above the average for the benchmark group (Financial Control - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 37% above the average of all other test-takers.

Henrik Dennerheim's score was 27% above the average for the benchmark group (Financial Control - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 37% above the average of all other test-takers.

Henrik Dennerheim's score was 27% above the average for the benchmark group (Financial Control - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 9% above the average for the benchmark group (Financial Control - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 87% above the average for the benchmark group (Financial Control - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 49% below the average for the benchmark group (Financial Control - Specialist, 4-6 yrs).

At present, there is not enough benchmark data collected for the profile (Financial Control - Specialist, 4-6 yrs) to generate a meaningful comparison.

| Question | Question area | Question type | Time | Status | Level |

|---|---|---|---|---|---|

| 5 | Closing of Accounts |

Record anticipated customer losses

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:06 | Difficult | |

| 6 | Financial Analysis |

Break down of profitability into profit margin and capital turnover rate

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:18 | Difficult | |

| 7 | Income Statement & Balance Sheet |

Meaning of Comprehensive Income

1 of 2 correct answers and 0 wrong and got 1,5 out of 3 points |

00:13 | Difficult | |

| 8 | Closing of Accounts |

Accrual of a customer invoice, prepaid revenue as portion of invoiced period (recording)

0 of 1 correct answers and 1 wrong and got 0 out of 3 points |

00:09 | Difficult | |

| 10 | Accounting Theory |

Financial instruments at fair value or cost, IFRS vs. K3

1 of 2 correct answers and 1 wrong and got 0 out of 3 points |

00:15 | Difficult | |

| 11 | Financial Analysis |

The Components of the Leverage Relationship

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:20 | Difficult | |

| 13 | Accounting Theory |

Percentage of completion method, meaning and purpose in accounting

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:17 | Difficult | |

| 16 | Income Statement & Balance Sheet |

Meaning of Provisions

0 of 2 correct answers and 0 wrong and got 0 out of 3 points |

00:06 | Difficult | |

| 1 | Financial Analysis |

Calculate Solvency

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:16 | Easy | |

| 2 | Closing of Accounts |

Accrual of a supplier invoice at year-end, statements of correct handling

0 of 1 correct answers and 1 wrong and got 0 out of 1 points |

00:29 | Easy | |

| 9 | Closing of Accounts |

Reconciliations, interpreting a specification of accounts receivable and its meaning

2 of 2 correct answers and 0 wrong and got 1 out of 1 points |

00:09 | Easy | |

| 12 | Financial Analysis |

Calculate Debt-to-Equity Ratio

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:09 | Easy | |

| 19 | Income Statement & Balance Sheet |

Year-End Adjustments, Accelerated Depreciation

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:15 | Easy | |

| 22 | Income Statement & Balance Sheet |

Format, Functional Income Statement

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:21 | Easy | |

| 23 | Accounting Theory |

Debit & Credit - consequences when posting a debit entry to a liability account

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:08 | Easy | |

| 24 | Accounting Theory |

Vouchers, meaning and purpose in accounting

3 of 3 correct answers and 0 wrong and got 1 out of 1 points |

00:10 | Easy | |

| 3 | Accounting Theory |

Accrued expense, definition and meaning in accounting

2 of 2 correct answers and 0 wrong and got 2 out of 2 points |

00:17 | Intermediate | |

| 4 | Financial Analysis |

Accounts Receivable, Derive Revenue through Credit Period

0 of 1 correct answers and 0 wrong and got 0 out of 2 points |

00:06 | Intermediate | |

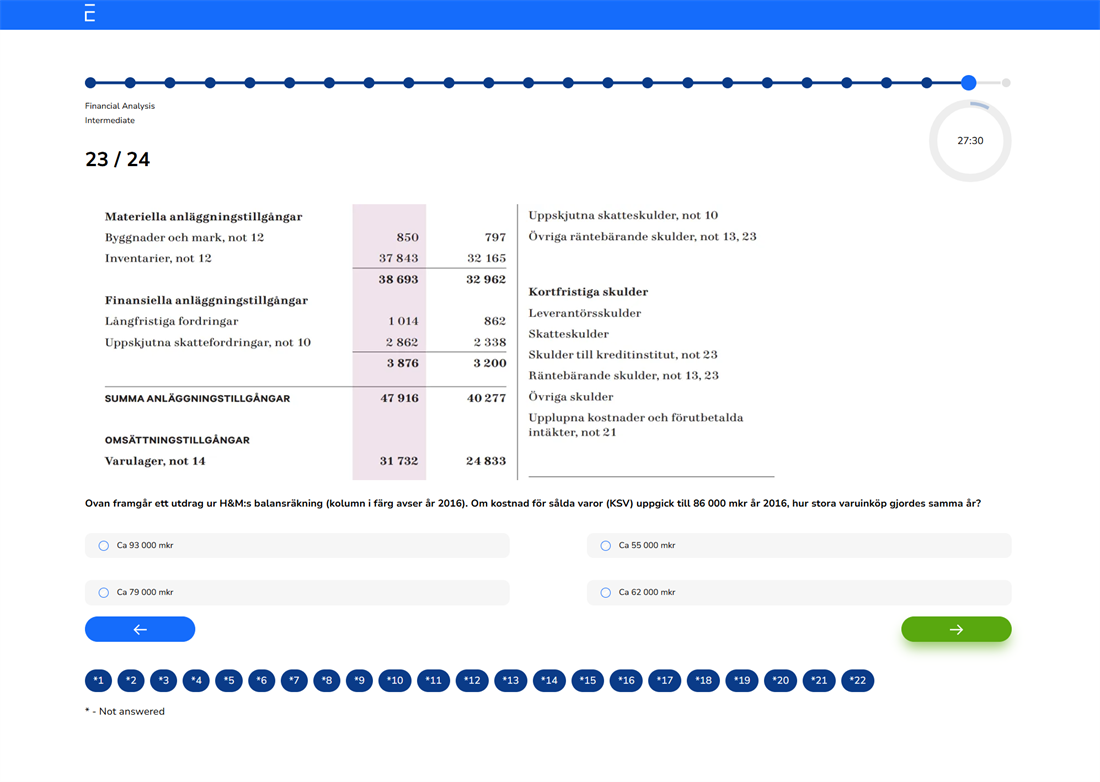

| 14 | Financial Analysis |

Derive Purchases through the Income Statement and Balance Sheet

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

01:45 | Intermediate | |

| 15 | Accounting Theory |

Costs, definition and significance in accounting

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:07 | Intermediate | |

| 17 | Closing of Accounts |

Closing VAT accounts, interpreting a VAT report (recording)

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:17 | Intermediate | |

| 18 | Closing of Accounts |

At year-end, valuation of inventory, interpret a calculation, and record an increase (posting)

0 of 1 correct answers and 0 wrong and got 0 out of 2 points |

00:06 | Intermediate | |

| 20 | Income Statement & Balance Sheet |

Equity, Fund and New Issuances

0 of 2 correct answers and 0 wrong and got 0 out of 2 points |

00:05 | Intermediate | |

| 21 | Income Statement & Balance Sheet |

Meaning of Free Cash Flow

2 of 3 correct answers and 0 wrong and got 1,3 out of 2 points |

00:19 | Intermediate |

Correct answer

Weighted point, partly right on the question

Wrong answer

Either skipped or out of time

TEST AREAS

"SEPARATING ANALYSTS FROM ACCOUNTANTS"

Test in Swedish on Swedish GAAP, distinguishing candidates managing Closing of Accounts and Reporting from those with strong Financial Analysis skills and deep knowledge of Income Statements and Balance Sheets.

Income Statement & Balance Sheet

The candidate's knowledge relating to both simpler aspects such as different presentation formats, asset categories, short-term and long-term liabilities, equity, operational performance measures etc, as well as more advanced topics - for example fund and new issues, free cash flow, provisions, capitalised tax loss carryforwards, comprehensive income, leasing, consolidation principles in group financial statements, and more.

Financial Analysis

Proficiency in recognised financial key ratios such as solvency, debt-to-equity ratio, and interest coverage ratio, understanding and calculation of profitability, credit periods through accounts receivable and accounts payable, capital binding, and the impact of financial leasing on profitability and cash flow, among others. Also, more complex analysis such as knowledge of the components of leverage and DuPont relationships, adjusted equity, the impact of working capital on cash flow, etc.

Closing of Accounts

The candidate's knowledge regarding account reconciliations, accruals, various interim accounts and skills in closing VAT accounts, accrual of invoices, recording of taxes and inventory, computation of taxable income, and accounting for anticipated and recognised customer losses, among other things.

Accounting Theory

Understanding the meaning and purpose of verifications, monthly reconciliations, accruals, accrued and prepaid items, definitions of revenue and expenses, consolidated financial statements, elimination of internal transactions, percentage of completion, significance of various accounting principles, indirect method regarding cash flow, IFRS vs. K3 regarding financial instruments, and useful life for intangible assets, among others.

TEST QUESTIONS

Multiple Choice

Our tests are mainly based on multiple-choice questions where the number of correct answer options varies. Each question has four answer options.

Questions by Area and Difficulty

The tests are divided into four question areas and questions are categorised into three difficulty levels: easy, intermediate and difficult.

Randomised Test Generation

Questions within each area and difficulty level are randomly selected from a question bank, ensuring that each test receives a unique set of questions. Additionally, the order of answer options is randomised so that the correct answer for each question never appears in the same position.

24 Questions and Multimedia Options

A total of 24 questions are generated and must be answered within 30 minutes. During the test, candidates can skip questions and come back to them later. They also have access to a timer and a progress indicator. The test will automatically close when the maximum time limit is reached.

Test questions and answer options can consist of text, images, or a combination of text and images.

Example Question