Excel 1 - SV - SV settings

The Everyday Excel UserTest in Swedish with Excel in Swedish settings. Ideal for candidates with limited data-intensive tasks or complex models. Assesses general proficiency in everyday use.

Date

24 Jan 2025

| Candidate: |

Henrik Dennerheim |

| Competence: |

Competent - level: 3 of 4 |

| Time spent: |

12:32 of 35:00 |

| Issuer: |

Demo Kunskapstest, EPROVED |

|

Candidate verified as:

|

HENRIK DENNERHEIM |

| Test | Competence | Points | Answered | Status | Date |

|---|---|---|---|---|---|

|

Qualified Accountant - EN - SV GAAP |

1/4 |

0% |

0/24 |

Complete |

2025-04-02 15:17:07 |

|

Qualified Accountant - EN - SV GAAP |

3/4 |

69% |

23/24 |

Complete |

2025-01-24 11:21:13 |

|

Qualified Accountant - EN - SV GAAP |

3/4 |

61% |

23/24 |

Complete |

2025-01-24 11:05:20 |

The candidate exhibits strong expertise in accounting and is proficient in bookkeeping, closing accounts, fixed assets, and accounting theory, among other areas.

Beginner

0% - 24%

Basic Proficiency

25% - 49%

Competent

50% - 76%

Skilled

77% - 100%

The candidate demonstrates strong proficiency in accounting, including posting customer and supplier invoices, handling representation, receipts, expenses, accounting corrections, payroll, accrued vacation pay, and more.

The candidate exhibits strong proficiency in closing accounts, including reconciliations, accruals, inventory, taxes, and VAT, and is likely capable of independently managing financial closings.

The candidate demonstrates strong knowledge of fixed assets, including depreciation, the rules regarding tangible and intangible assets, impairments, acquisitions, and disposals.

The candidate demonstrates strong theoretical knowledge in accounting and, in addition to basic bookkeeping, is able to understand definitions, accruals, interim accounts with conceptual pairs, accounting principles, methods for cash flow analysis, and more.

Points

Time

Henrik Dennerheim's score was 116% above the average of all other test-takers.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

Henrik Dennerheim's score was 116% above the average of all other test-takers.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

Henrik Dennerheim's score was 116% above the average of all other test-takers.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

At present, there is not enough benchmark data collected for the profile (Qualified Accounting - Specialist, 4-6 yrs) to generate a meaningful comparison.

| Question | Question area | Question type | Time | Status | Level |

|---|---|---|---|---|---|

| 5 | Bookkeeping |

Record accrued vacation pay upon a decrease in accrued vacation liability

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

01:32 | Difficult | |

| 8 | Fixed Assets |

Tax depreciation, calculate main and supplementary rules (SWE: huvud- och kompletteringsregeln)

0 of 1 correct answers and 1 wrong and got 0 out of 3 points |

00:13 | Difficult | |

| 9 | Accounting Theory |

Consolidated financial statements, rules for when consolidation shall occur (including ownership percentage, significant influence, acquisition method)

0 of 2 correct answers and 1 wrong and got 0 out of 3 points |

00:20 | Difficult | |

| 10 | Closing of Accounts |

Taxable income, difference from annual profit, and various components in the calculation

2 of 2 correct answers and 0 wrong and got 3 out of 3 points |

00:50 | Difficult | |

| 11 | Bookkeeping |

Record payroll payment on the 25th, including social charges & income tax (SWE: Sociala avg. & A-skatt)

0 of 1 correct answers and 1 wrong and got 0 out of 3 points |

00:55 | Difficult | |

| 14 | Accounting Theory |

Matching principle, definition and meaning in accounting

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:20 | Difficult | |

| 15 | Closing of Accounts |

Record recognized customer losses

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:09 | Difficult | |

| 19 | Fixed Assets |

IFRS, impairment test - goodwill - positive NPV (Net Present Value)

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:21 | Difficult | |

| 1 | Fixed Assets |

Depreciation of tangible fixed assets, economic useful life vs. physical useful life

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:17 | Easy | |

| 2 | Accounting Theory |

Monthly reconciliations, meaning and purpose in accounting

2 of 2 correct answers and 1 wrong and got 0 out of 1 points |

00:31 | Easy | |

| 7 | Accounting Theory |

Specify the account group, bank account in the accounting

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:10 | Easy | |

| 13 | Fixed Assets |

Impairment of fixed assets, tangible vs. intangible & depreciation vs. impairment

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:14 | Easy | |

| 18 | Bookkeeping |

Record supplier invoice, invoicing method for VAT taxable sales (posting)

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:26 | Easy | |

| 21 | Closing of Accounts |

Reconciliations, interpreting a specification of accounts receivable and its meaning

2 of 2 correct answers and 0 wrong and got 1 out of 1 points |

00:13 | Easy | |

| 22 | Closing of Accounts |

Accrual of supplier invoices at year-end, interim receivable vs. interim liability

2 of 2 correct answers and 0 wrong and got 1 out of 1 points |

00:29 | Easy | |

| 23 | Bookkeeping |

Rules for correcting incorrectly recorded transactions, including reverse debit and credit

3 of 3 correct answers and 0 wrong and got 1 out of 1 points |

00:29 | Easy | |

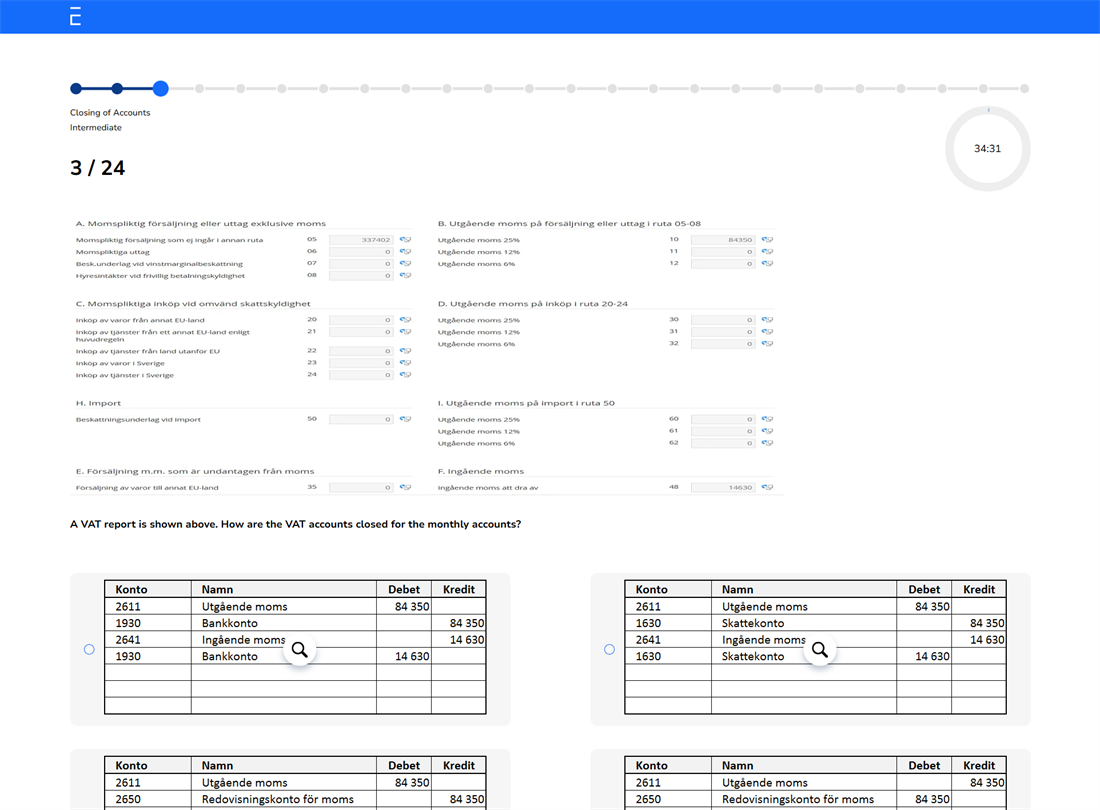

| 3 | Closing of Accounts |

Closing VAT accounts, interpreting a VAT report (recording)

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:38 | Intermediate | |

| 4 | Accounting Theory |

Costs, definition and significance in accounting

0 of 1 correct answers and 3 wrong and got 0 out of 2 points |

00:51 | Intermediate | |

| 6 | Accounting Theory |

Consolidated financial statements, how intra-group transactions are handled

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:14 | Intermediate | |

| 12 | Fixed Assets |

Tax depreciation, impact on the income statement and balance sheet

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:34 | Intermediate | |

| 16 | Fixed Assets |

Impairment of assets, calculate depreciation and write-down in the financial statements due to a market value decline

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:54 | Intermediate | |

| 17 | Closing of Accounts |

Accrual of a received supplier invoice, relevant accounts for prepaid expenses

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:19 | Intermediate | |

| 20 | Bookkeeping |

Record representation expenses, alcoholic beverages (posting)

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:28 | Intermediate | |

| 24 | Bookkeeping |

Record representation, lunch with a customer (posting)

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:47 | Intermediate |

Correct answer

Weighted point, partly right on the question

Wrong answer

Either skipped or out of time

TEST AREAS

"ACCOUNTING FROM A TO Z"

Test in English on Swedish GAAP. Differentiates qualified accountants from support profiles handling day-to-day accounting.

Questions and answer choices are in English to facilitate reading comprehension for candidates whose native language is not Swedish. However, images, accounting boxes, etc., remain in Swedish.

Bookkeeping

Testing of both basic bookkeeping, e.g. common customer and supplier invoices, representation and receipts, correction of a recorded transaction, credit invoices etc, to more advanced accounting - e.g. salaries, accrued vacation pay, invoices in foreign currency, tax revenues, etc.

Closing of Accounts

The candidate's knowledge regarding account reconciliations, accruals, various interim accounts and skills in closing VAT accounts, accrual of invoices, recording of taxes and inventory, computation of taxable income, and accounting for anticipated and recognised customer losses, among other things.

Fixed Assets

The candidate's knowledge regarding various types of fixed assets, fixed asset registers, depreciation and write-downs, tax depreciation, main and supplementary rules (SV: Huvud- och Kompletteringsregeln), consumable inventories, goodwill, impairment testing under IFRS, calculation of capital gains, etc.

Accounting Theory

Understanding the meaning and purpose of verifications, monthly reconciliations, accruals, accrued and prepaid items, definitions of revenue and expenses, consolidated financial statements, elimination of internal transactions, percentage of completion, significance of various accounting principles, indirect method regarding cash flow, IFRS vs. K3 regarding financial instruments, and useful life for intangible assets, among others.

TEST QUESTIONS

Multiple Choice and Manual Entry Questions

Our tests are mainly based on multiple-choice questions where the number of correct answer options varies. Each question has four answer options. Some questions require manual recording of a business transaction, and the candidate is provided with a chart of accounts for assistance.

Questions by Area and Difficulty

The tests are divided into four question areas and questions are categorised into three difficulty levels: easy, intermediate and difficult.

Randomised Test Generation

Questions within each area and difficulty level are randomly selected from a question bank, ensuring that each test receives a unique set of questions. Additionally, the order of answer options is randomised so that the correct answer for each question never appears in the same position.

24 Questions and Multimedia Options

A total of 24 questions are generated and must be answered within 35 minutes. During the test, candidates can skip questions and come back to them later. They also have access to a timer and a progress indicator. The test will automatically close when the maximum time limit is reached.

Test questions and answer options can consist of text, images, or a combination of text and images.

Example Question