Excel 1 - SV - SV settings

The Everyday Excel UserTest in Swedish with Excel in Swedish settings. Ideal for candidates with limited data-intensive tasks or complex models. Assesses general proficiency in everyday use.

Date

07 May 2025

| Candidate: |

Henrik Dennerheim |

| Competence: |

Competent - level: 3 of 4 |

| Time spent: |

09:47 of 35:00 |

| Issuer: |

Demo Kunskapstest, EPROVED |

| Test | Competence | Points | Answered | Status | Date |

|---|---|---|---|---|---|

|

Accountant - SV |

3/4 |

56% |

19/24 |

Complete |

2025-05-07 09:56:04 |

|

Löpande redovisning |

1/4 |

18% |

6/24 |

Complete |

2024-05-24 11:42:40 |

|

Löpande redovisning |

1/4 |

16% |

10/24 |

Complete |

2024-04-30 09:40:55 |

|

Löpande redovisning |

1/4 |

0% |

0/24 |

Complete |

2023-01-17 13:32:51 |

|

Löpande redovisning |

1/4 |

20% |

16/24 |

Complete |

2022-10-08 09:17:49 |

|

Löpande redovisning |

1/4 |

9% |

7/24 |

Complete |

2022-10-06 16:23:33 |

|

Löpande redovisning |

2/4 |

30% |

10/24 |

Complete |

2022-06-01 13:40:05 |

|

Löpande redovisning |

1/4 |

0% |

0/24 |

Complete |

2022-03-30 14:15:09 |

The candidate exhibits strong proficiency in accounting and is skilled in bookkeeping, handling receipts, managing expenses, and maintaining accounts receivable and payable, among other aspects.

Beginner

0% - 24%

Basic Proficiency

25% - 49%

Competent

50% - 76%

Skilled

77% - 100%

The candidate has introductory knowledge of accounting, including an understanding of the difference between debit and credit.

The candidate exhibits strong proficiency in closing accounts, including reconciliations, accruals, inventory, taxes, and VAT, and is likely capable of independently managing financial closings.

The candidate demonstrates strong knowledge in accounts receivable and accounts payable, including invoice handling, ledger reconciliation, payments, accounting adjustments, and has a solid understanding of related processes and routines.

The candidate demonstrates strong knowledge of expense management, including the recording of receipts, representation, and travel expenses, calculation of tax-free per diems, as well as archiving rules.

Points

Time

Points

Time

Henrik Dennerheim's score was 6% above the average of all other test-takers.

Henrik Dennerheim's score was 2% above the average for the benchmark group (Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 6% above the average of all other test-takers.

Henrik Dennerheim's score was 2% above the average for the benchmark group (Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 6% above the average of all other test-takers.

Henrik Dennerheim's score was 2% above the average for the benchmark group (Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 82% below the average for the benchmark group (Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 22% above the average for the benchmark group (Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 31% above the average for the benchmark group (Accounting - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 66% above the average for the benchmark group (Accounting - Specialist, 4-6 yrs).

| Question | Question area | Question type | Time | Status | Level |

|---|---|---|---|---|---|

| 7 | Bookkeeping |

Correct an incorrectly recorded transaction, statements regarding reverse debit and credit

0 of 2 correct answers and 1 wrong and got 0 out of 3 points |

00:09 | Difficult | |

| 8 | Expense Management |

Travel expenses, calculate tax-free per diem between two dates

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:08 | Difficult | |

| 10 | Accounts Receivable & Payable |

Reconciliation of accounts receivable

2 of 2 correct answers and 0 wrong and got 3 out of 3 points |

00:12 | Difficult | |

| 14 | Expense Management |

Travel expenses, calculate tax-free per diem between two dates

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:05 | Difficult | |

| 17 | Accounts Receivable & Payable |

Accrual of accounts payable invoice

2 of 2 correct answers and 0 wrong and got 3 out of 3 points |

00:32 | Difficult | |

| 18 | Closing of Accounts |

Taxable income, difference from annual profit, and various components in the calculation

1 of 2 correct answers and 0 wrong and got 1,5 out of 3 points |

00:26 | Difficult | |

| 21 | Closing of Accounts |

Accrual of a customer invoice, prepaid revenue as portion of invoiced period (recording)

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:07 | Difficult | |

| 24 | Bookkeeping |

Record accrued vacation pay upon a decrease in accrued vacation liability

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:15 | Difficult | |

| 1 | Expense Management |

VAT rate on travel

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:11 | Easy | |

| 2 | Accounts Receivable & Payable |

Account group, VAT (Value Added Tax)

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:06 | Easy | |

| 9 | Expense Management |

VAT rate on meals

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:06 | Easy | |

| 11 | Closing of Accounts |

Accruals, interim receivables vs. interim liabilities

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:13 | Easy | |

| 15 | Bookkeeping |

Rules for correcting incorrectly recorded transactions, including reverse debit and credit

3 of 3 correct answers and 0 wrong and got 1 out of 1 points |

00:18 | Easy | |

| 16 | Closing of Accounts |

Meaning of monthly reconciliations, various statements

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:12 | Easy | |

| 20 | Accounts Receivable & Payable |

Accounts receivable, meaning and purpose in accounting

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:14 | Easy | |

| 23 | Bookkeeping |

Record representation expenses and necessary information on the receipt

1 of 2 correct answers and 0 wrong and got 0,5 out of 1 points |

00:12 | Easy | |

| 3 | Accounts Receivable & Payable |

Ledger, manual reconciliation

1 of 2 correct answers and 0 wrong and got 1 out of 2 points |

00:30 | Intermediate | |

| 4 | Expense Management |

Recording representation, alcoholic beverages

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:22 | Intermediate | |

| 5 | Bookkeeping |

Record customer invoice, credit invoice under the invoice method, and VAT taxable sales (posting) *

0 of 3 correct answers and 1 wrong and got 0 out of 2 points |

04:17 | Intermediate | |

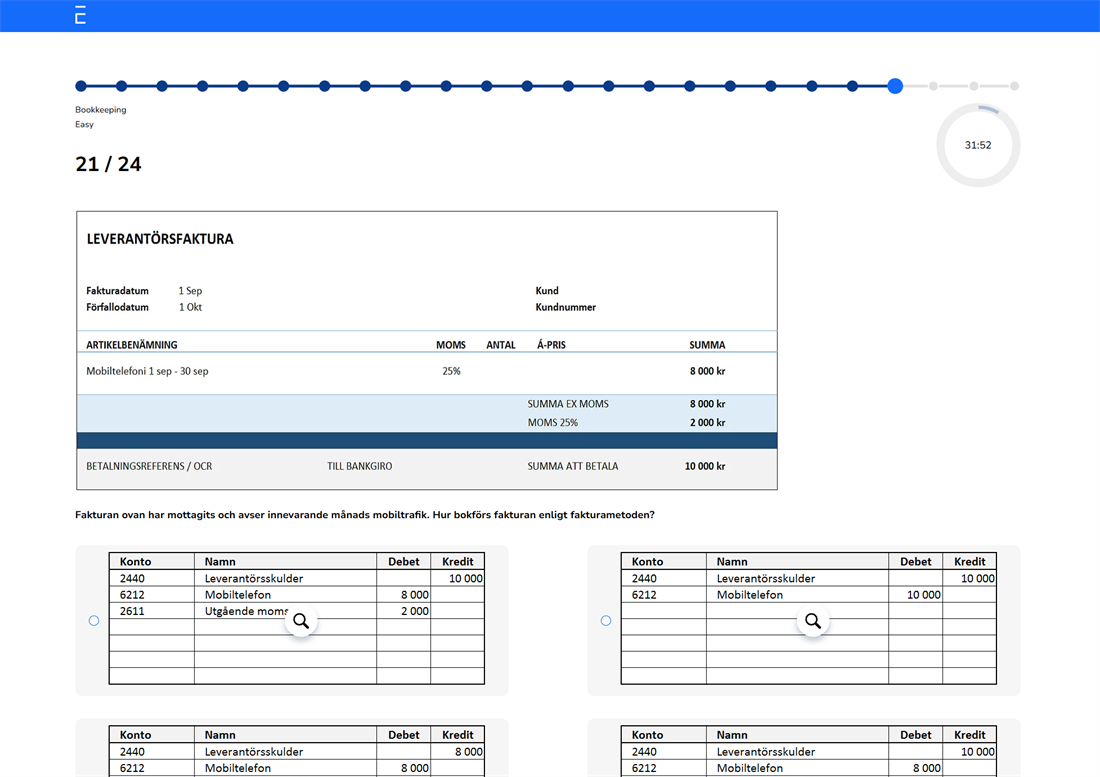

| 6 | Bookkeeping |

Record supplier invoice, debit invoice under the invoice method, and VAT taxable sales (posting) *

0 of 3 correct answers and 0 wrong and got 0 out of 2 points |

00:02 | Intermediate | |

| 12 | Expense Management |

Receipts, required information to create a voucher

2 of 2 correct answers and 0 wrong and got 2 out of 2 points |

00:18 | Intermediate | |

| 13 | Accounts Receivable & Payable |

Customer payment, deviating amount

0 of 2 correct answers and 0 wrong and got 0 out of 2 points |

00:09 | Intermediate | |

| 19 | Closing of Accounts |

Accrual of a received supplier invoice, relevant accounts for prepaid expenses

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:13 | Intermediate | |

| 22 | Closing of Accounts |

Closing VAT accounts, interpreting a VAT report (recording)

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:15 | Intermediate |

* - Questions with this symbol are account distribution questions.

Correct answer

Weighted point, partly right on the question

Wrong answer

Either skipped or out of time

TEST AREAS

"DAY-TO-DAY ACCOUNTING"

Test in Swedish on Swedish GAAP, focusing on daily tasks such as bookkeeping, accounts receivable and payable, expense management, and account closing.

Bookkeeping

Testing of both basic bookkeeping, e.g. common customer and supplier invoices, representation and receipts, correction of a recorded transaction, credit invoices etc, to more advanced accounting - e.g. salaries, accrued vacation pay, invoices in foreign currency, tax revenues, etc.

Accounts Receivable & Payable

The candidate's knowledge ranges from basic understanding and handling of ledgers, invoices, input and output VAT, accounts, manual reconciliation, payments, bank transfers, accounting dates etc, to more advanced aspects such as discrepancies, credit invoices, accrual of customer and supplier invoices, incorrect invoices, international payments etc.

Expense Management

The candidate's knowledge regarding receipt management, representation, archiving rules, various VAT rates, accounting for representation of meals and alcoholic beverages, travel expenses, tax-free per diems, foreign invoices, reverse charge, etc.

Closing of Accounts

The candidate's knowledge regarding account reconciliations, accruals, various interim accounts and skills in closing VAT accounts, accrual of invoices, recording of taxes and inventory, computation of taxable income, and accounting for anticipated and recognised customer losses, among other things.

TEST QUESTIONS

Multiple Choice and Manual Entry Questions

Our tests are mainly based on multiple-choice questions where the number of correct answer options varies. Each question has four answer options. Some questions require manual recording of a business transaction, and the candidate is provided with a chart of accounts for assistance.

Questions by Area and Difficulty

The tests are divided into four question areas and questions are categorised into three difficulty levels: easy, intermediate and difficult.

Randomised Test Generation

Questions within each area and difficulty level are randomly selected from a question bank, ensuring that each test receives a unique set of questions. Additionally, the order of answer options is randomised so that the correct answer for each question never appears in the same position.

24 Questions and Multimedia Options

A total of 24 questions are generated and must be answered within 35 minutes. During the test, candidates can skip questions and come back to them later. They also have access to a timer and a progress indicator. The test will automatically close when the maximum time limit is reached.

Test questions and answer options can consist of text, images, or a combination of text and images.

Example Question