Excel 1 - SV - SV settings

The Everyday Excel UserTest in Swedish with Excel in Swedish settings. Ideal for candidates with limited data-intensive tasks or complex models. Assesses general proficiency in everyday use.

Date

12 May 2025

| Candidate: |

Henrik Dennerheim |

| Competence: |

Basic Proficiency - level: 2 of 4 |

| Time spent: |

07:47 of 30:00 |

| Issuer: |

Demo Kunskapstest, EPROVED |

| Test | Competence | Points | Answered | Status | Date |

|---|---|---|---|---|---|

|

Payroll Administrator - SV |

2/4 |

26% |

18/24 |

Complete |

2025-05-12 13:41:55 |

|

Löneadministratör |

2/4 |

31% |

12/24 |

Complete |

2024-10-16 10:32:17 |

|

Löneadministratör |

1/4 |

8% |

5/24 |

Complete |

2021-09-13 09:28:19 |

The candidate has basic knowledge of payroll administration.

Beginner

0% - 24%

Basic Proficiency

25% - 49%

Competent

50% - 76%

Skilled

77% - 100%

The candidate demonstrates strong knowledge of labour law and is well-versed in laws, types of employment, collective agreements, and regulations regarding overtime, vacation, sick leave, and more.

The candidate has introductory knowledge of leave and absence, including familiarity with the holiday year, holiday compensation, and deductible period.

The candidate is familiar with basic rules regarding compensation and taxes, including the existence of tax-exempt benefits and wellness benefits.

The candidate has introductory knowledge of payroll calculation and accounting, including awareness of different types of payroll elements, certain accounts used in payroll bookkeeping, and how to calculate net salary.

Points

Time

Points

Time

Henrik Dennerheim's score was 52% below the average of all other test-takers.

Henrik Dennerheim's score was 54% below the average for the benchmark group (Payroll Administration - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 52% below the average of all other test-takers.

Henrik Dennerheim's score was 54% below the average for the benchmark group (Payroll Administration - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 52% below the average of all other test-takers.

Henrik Dennerheim's score was 54% below the average for the benchmark group (Payroll Administration - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 21% above the average for the benchmark group (Payroll Administration - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 66% below the average for the benchmark group (Payroll Administration - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 86% below the average for the benchmark group (Payroll Administration - Specialist, 4-6 yrs).

Henrik Dennerheim's score was 87% below the average for the benchmark group (Payroll Administration - Specialist, 4-6 yrs).

| Question | Question area | Question type | Time | Status | Level |

|---|---|---|---|---|---|

| 5 | Leave & Absence |

Parental leave, calculation of hourly wage deduction

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:10 | Difficult | |

| 6 | Employment Law |

Regulations on Accrued Vacation according to the Vacation Act (SV: "Semesterlagen")

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:19 | Difficult | |

| 7 | Leave & Absence |

Vacation year vs. earning year, paid & unpaid vacation days

0 of 2 correct answers and 2 wrong and got 0 out of 3 points |

00:08 | Difficult | |

| 9 | Salary Calculation & Accounting |

Account for salary, income tax, vacation accrual, and employer contributions (posting)

0 of 1 correct answers and 1 wrong and got 0 out of 3 points |

00:35 | Difficult | |

| 12 | Employment Law |

Benefit and Defined Contribution Pension Plans & Special Payroll Tax

1 of 1 correct answers and 0 wrong and got 3 out of 3 points |

00:18 | Difficult | |

| 18 | Compensation & Tax |

Travel expenses, calculate reduced tax-free per diem per day for continuous business trips exceeding 3 months

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:08 | Difficult | |

| 22 | Salary Calculation & Accounting |

Managing accrued vacation and paid advance vacation, termination vs. terminated

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:04 | Difficult | |

| 24 | Compensation & Tax |

Travel expenses, calculate tax-free per diem between two dates

0 of 1 correct answers and 0 wrong and got 0 out of 3 points |

00:06 | Difficult | |

| 1 | Salary Calculation & Accounting |

Existence of salary components

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:10 | Easy | |

| 2 | Salary Calculation & Accounting |

Benefit value, calculate net salary (applying tax rate)

0 of 1 correct answers and 1 wrong and got 0 out of 1 points |

00:27 | Easy | |

| 10 | Employment Law |

The Minimum Number of Days for Vacation Entitlement According to the Vacation Act (SV: "Semesterlagen")

0 of 1 correct answers and 1 wrong and got 0 out of 1 points |

00:17 | Easy | |

| 13 | Compensation & Tax |

Tax-exempt gifts to employees

0 of 1 correct answers and 0 wrong and got 0 out of 1 points |

00:14 | Easy | |

| 14 | Employment Law |

Permissible Overtime According to the Working Hours Act (SV: "Arbetstidslagen")

0 of 1 correct answers and 1 wrong and got 0 out of 1 points |

00:09 | Easy | |

| 15 | Compensation & Tax |

Tax-exempt benefits

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:10 | Easy | |

| 16 | Leave & Absence |

Compensation for short-term sick leave, waiting period, and compensation level

0 of 1 correct answers and 1 wrong and got 0 out of 1 points |

02:18 | Easy | |

| 20 | Leave & Absence |

Compensation during vacation, vacation pay 12%

1 of 1 correct answers and 0 wrong and got 1 out of 1 points |

00:23 | Easy | |

| 3 | Leave & Absence |

Vacation pay qualifying absence reasons (sick leave, personal leave, parental leave, vacation)

2 of 3 correct answers and 0 wrong and got 1,3 out of 2 points |

00:13 | Intermediate | |

| 4 | Salary Calculation & Accounting |

Calculate gross salary, sick leave deduction including waiting period (SV: "karens")

0 of 1 correct answers and 1 wrong and got 0 out of 2 points |

00:05 | Intermediate | |

| 8 | Leave & Absence |

Calculate accrued vacation during absences of less than 120 days with temporary parental leave (earning year 1/4-31/3)

0 of 1 correct answers and 1 wrong and got 0 out of 2 points |

00:05 | Intermediate | |

| 11 | Employment Law |

Recruitment of Employees, Eligibility of Labor Unions under Collective Agreements for Participation in the Recruitment Process

0 of 1 correct answers and 1 wrong and got 0 out of 2 points |

00:19 | Intermediate | |

| 17 | Compensation & Tax |

Wellness allowance, tax-exempt maximum amount

0 of 1 correct answers and 1 wrong and got 0 out of 2 points |

00:14 | Intermediate | |

| 19 | Salary Calculation & Accounting |

Calculate monthly salary during vacation, percentage rule (vacation pay & vacation deduction)

0 of 1 correct answers and 0 wrong and got 0 out of 2 points |

00:11 | Intermediate | |

| 21 | Employment Law |

Maximum Duration of Temporary Employment (SV: "Vikariat")

1 of 1 correct answers and 0 wrong and got 2 out of 2 points |

00:09 | Intermediate | |

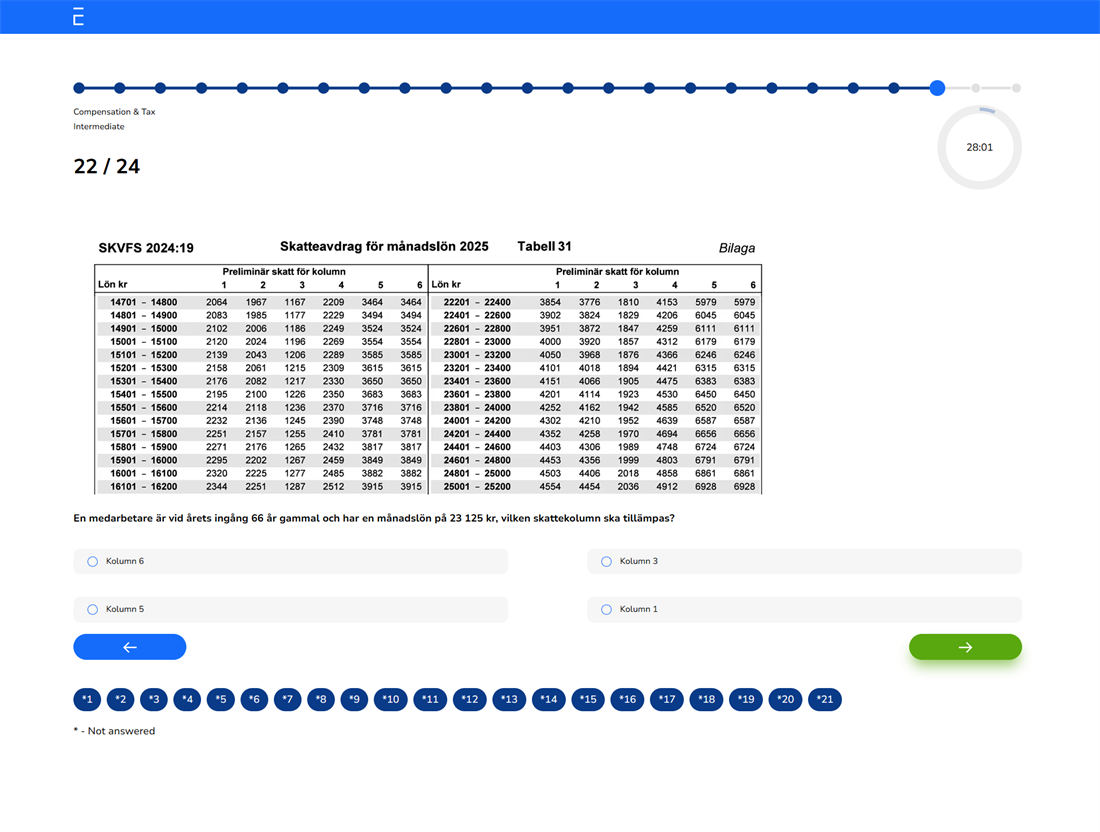

| 23 | Compensation & Tax |

Mileage reimbursement, tax-exempt amount

1 of 1 correct answers and 1 wrong and got 0 out of 2 points |

00:19 | Intermediate |

Correct answer

Weighted point, partly right on the question

Wrong answer

Either skipped or out of time

TEST AREAS

"FROM LAW TO PAYROLL PRACTICE"

Payroll test in Swedish on Swedish regulations, covering key areas such as employment law, leave and absence management, compensation and tax calculations, as well as payroll processing and accounting practices.

Employment Law

The candidate's knowledge pertaining to various laws - for example, the Holiday Act and the Employment Protection Act (SV: LAS) - different types of employment contracts, the significance of collective bargaining agreements, regulations concerning overtime, occupational pensions, benefit- and contribution-defined pension plans, among others.

Leave & Absence

Basic and advanced knowledge regarding compensation and payroll deductions in the event of leave and absence, for example, holiday pay, holiday compensation, holiday year versus earning year, paid and unpaid holiday days, parental leave, deductible period, and the Swedish Social Insurance Agency's regulations (SV: "Försäkringskassan") for care of sick child (VAB), among other aspects.

Compensation & Tax

The candidate's knowledge regarding various compensations, such as tax-exempt benefits, mileage allowance, tax-free per diems, personal expenses and travel expense reports, as well as taxes like preliminary income tax, tax tables, employer contributions, special payroll tax on pensions, etc.

Salary Calculation & Accounting

Calculations of gross and net salaries under various conditions, for example, during vacation, sick leave, parental leave, as well as laws and collective agreements as the basis for daily and hourly calculations for salary additions and deductions, handling of accrued vacation and paid advance vacation, as well as accounting for salary, income tax, vacation accrual, and employer contributions, etc.

TEST QUESTIONS

Multiple Choice

Our tests are mainly based on multiple-choice questions where the number of correct answer options varies. Each question has four answer options.

Questions by Area and Difficulty

The tests are divided into four question areas and questions are categorised into three difficulty levels: easy, intermediate and difficult.

Randomised Test Generation

Questions within each area and difficulty level are randomly selected from a question bank, ensuring that each test receives a unique set of questions. Additionally, the order of answer options is randomised so that the correct answer for each question never appears in the same position.

24 Questions and Multimedia Options

A total of 24 questions are generated and must be answered within 30 minutes. During the test, candidates can skip questions and come back to them later. They also have access to a timer and a progress indicator. The test will automatically close when the maximum time limit is reached.

Test questions and answer options can consist of text, images, or a combination of text and images.

Example Question